Views: 420

Antennas for 5G: Samsung, Intel, Ericsson, and Huawei and more have begun extending their portfolios

Yole Développement : Antennas for 5G and 5G-related applications: a young but already highly-competitive IP domain.

- Today, the IP landscape related to antenna for 5G is still unsettled.

- The main IP and market players – i.e. Samsung, Intel, Ericsson, and Huawei – have begun extending their portfolios worldwide.

Today, the IP landscape related to antenna for 5G is still unsettled, announces Knowmade. With more than 75% of patent applications still pending, much will change in the coming years.

“After an initial period of domestic patent applications, the main IP and market players including Samsung, Intel, Ericsson, and Huawei, have begun extending their portfolios worldwide”, comments Paul Leclaire, PhD. Patent & Technology Analyst at Knowmade.“Samsung and Intel appear to be the two leaders currently best-positioned to limit their main competitors’ patenting activity and freedom-to-operate.”

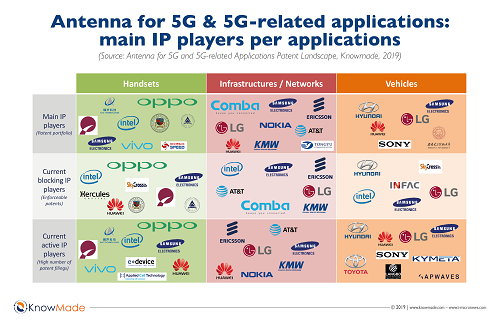

With its new patent landscape analysis, Antenna for 5G and 5G-related Applications, Knowmade proposes today a deep understanding the key players’ patented technologies and current IP strategies. According to Knowmade’s analysts, more than 620 patent applicants are involved in antennas’ development for 5G applications.

Under this dynamic context of development, this report is a real opportunity to get a deep understanding of the ecosystem and key players’ IP position through a detailed analysis of their patent portfolios. With this new analysis, Knowmade also explores capability of each player to limit other firms’ activities related to antenna for 5G.

What will be the impact at the antennas’ level, in term of technology evolution and market trends? How will leading players manage 5G introduction? What are the current R&D efforts made by these companies? What is the status of the IP landscape? Knowmade, partner of Yole Développement (Yole) proposes today a valuable and comprehensive overview of the antenna patent ecosystem.

5G wireless communication, expected to hit the market by 2020, is the next mobile technology standard. Therefore, 5G will totally redefine how RF front-end interacts in-between the network and the modem. Indeed, new RF sub-6 GHz, and mm-wave pose big challenges for industrials. However, with these challenges comes opportunity to disrupt the market’s leadership…

“On the 5G sub-6 GHz side, the current front-end leaders including Broadcom, Qorvo, Skyworks, and Murata have already begun adapting to these changes,” explains Cédric Malaquin, Technology & Market Analyst at Yole. And he adds: “Skyworks has launched its 5G Front End platform, Sky5TM and Qorvo will integrate 5G content in its high end LTE platform, RF Fusion™. Qualcomm has pushed the 5G mmWave approach with the commercial release of dedicated compact antenna in package to be integrated in smartphone corner.”

“Qualcomm is the new entrant that brings with it an end-to-end solution from modem to antenna”, explains Antoine Bonnabel, Technology & Market Analyst at Yole. “Also, strategic investment in TDK Epcos’ filtering technology has become profitable. The first revenue was generated in the RF front-end segment during 2017. At Yole, we can expect further revenue to come in the near future. A first mobile phone, Sony’s XZ2 already adopted Qualcomm’s complete solution.” …

Antoine is also engaged within the RF electronics activities at Yole and closely collaborates with Cédric to propose relevant technology & market analyses and presentations all year long. (1)

Along with mobile devices, 5G and 5G-related networks require the deployment of new infrastructures supporting specific protocols and operation modes, such as MIMO , massive MIMO, beamforming, beam steering, carrier aggregation, and others. In addition to increase the data rate and bandwidth, 5G devices must be compatible with many data types. 5G players must explore new frequency spectrums and more – especially the millimeter wave frequencies, from 20 GHz to 300 GHz. Among all RF components now in development for 5G applications including filters, power amplifiers, RF front-end modules, etc… the antenna has become a very complex, invaluable segment of the 5G network.

“It was only in 2014 that the term “5G” began appearing in patents. Since then, the number of 5G-related patent publications has seen a huge increase, with a growth rate of 113% from 2014 – 2018,” explains Paul Leclaire from Knowmade. “This strong acceleration is pushed mostly by Chinese IP players, which account for more than 56% of IP activity. In particular, we have noticed a large number of Chinese academic players, which is quite unusual in the telecom domain.”

Acronyms:

IP : Intellectual Property

MIMO : Multi-Input Multi-Output

Leave a Reply